In finance, bonds are a debt-based financial instrument. They’re issued by larger bodies, like the government or corporations. Bonds consist of the following structure:

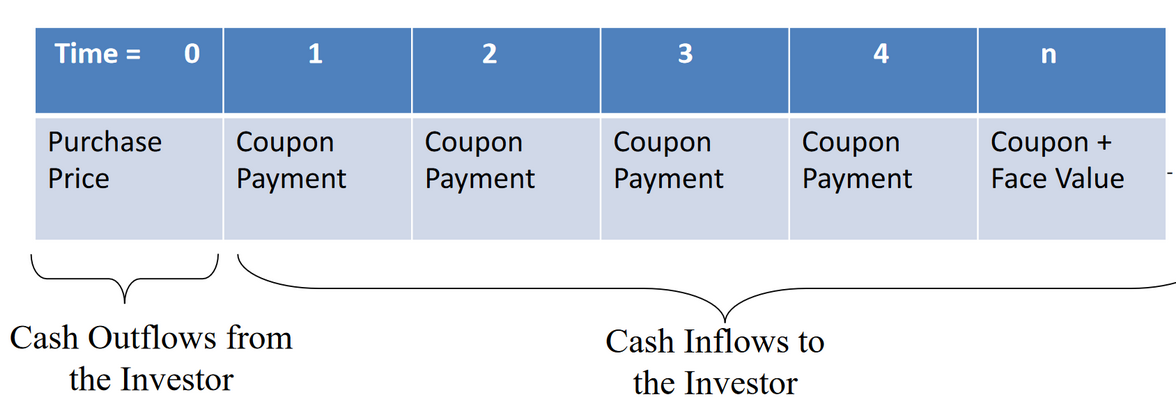

- An initial outflow paid by the investor to the issuer.

- A maturity value (or face/par value) paid to the holder of the bond at a pre-set maturity date.

- A fixed annual coupon rate, which specifies interest payments to be made on specific dates over the life of the bond. They’re paid periodically (semi-annually in North America).

- Dollar value of an annual coupon payment: coupon rate times face value.

- A fixed maturity date. The term-to-maturity is the time remaining until the bond’s maturity date.

Bonds are valued as the sum of annuity (coupon payments) and a single fixed value (maturity value). See the cash flow below:1

Bonds can be owned and transferred during their lifetime, since they don’t name the lender. There are two main types of bonds: secured and unsecured bonds. Secured bonds are backed by collateral. Unsecured bonds are not and depend on the issuer’s financial stability and creditworthiness (so only financially strong companies can issue these bonds).

Bonds can be owned and transferred during their lifetime, since they don’t name the lender. There are two main types of bonds: secured and unsecured bonds. Secured bonds are backed by collateral. Unsecured bonds are not and depend on the issuer’s financial stability and creditworthiness (so only financially strong companies can issue these bonds).

Generally, bonds are considered a secure investment compared to shares. This is because they represent a legal obligation enforced by the court to pay out the debt. In the case of default (failure to pay), the company will enter bankruptcy, sell assets to get cash, which will be used to pay bondholders. As a result, they’re more predictable than equity.

On the issuer’s side, issuing bonds is a cheap source of money for corporate financing (no dividends compared to equity). However, it’s more risky for the company, because of the legal obligation.